Ever spent hours figuring out how to cancel your convention insurance plan, only to end up feeling like you’re trapped in a never-ending bureaucratic maze? Yeah, us too. And guess what? You’re not alone.

In this blog post, we’ll break down everything you need to know about cancelling your convention insurance without falling into hidden fees or loopholes. We’ll cover the key questions (like “Can I even do this?”), actionable tips, and real-life examples that prove it *can* be done—sometimes even painlessly.

Table of Contents

- The Problem with Cancelling Convention Insurance Plans

- Step-by-Step Guide to Canceling Your Plan

- Best Practices for Navigating Cancellations

- Real-Life Examples of Successful Cancellations

- Frequently Asked Questions About Convention Insurance

Key Takeaways

- Canceling your convention insurance isn’t impossible—but timing is crucial.

- You may face penalties or refunds based on policy terms, so read the fine print.

- A pro tip: Document EVERYTHING when interacting with insurance providers.

- Sometimes, customer service reps will offer alternative solutions instead of outright cancellations.

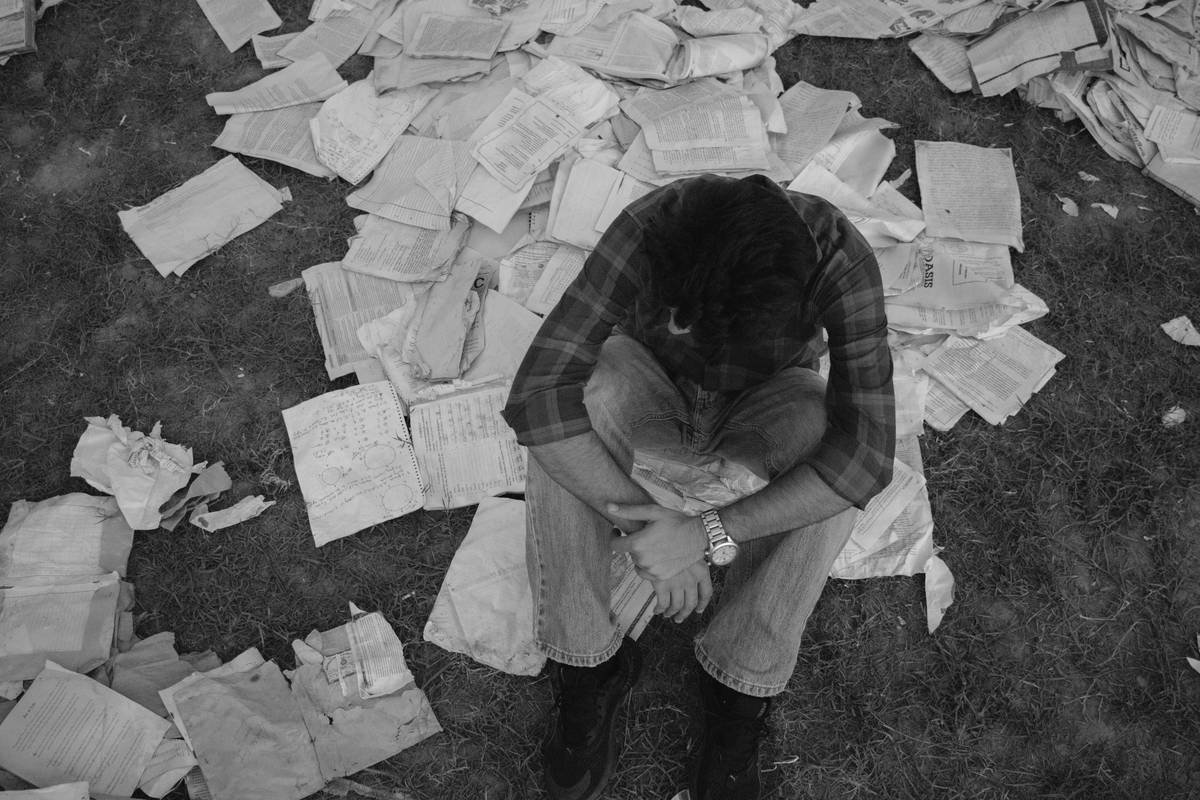

Why Is It So Painful to Cancel a Convention Insurance Plan?

Let me start by sharing one of my own epic fails. Last year, I signed up for an overpriced convention insurance plan thinking it was “mandatory” for attending an international trade show. Spoiler alert: it wasn’t mandatory, but oh boy, did they make me feel like breaking free from their clutches would require a lawyer. After several angry phone calls and emails, I managed to cancel—but not before losing $50 just because I missed some tiny clause buried deep in the contract.

Convention insurance plans are notorious for being confusingly worded documents designed to keep you locked in—or worse, penalized heavily if you try to leave early. Add limited cancellation windows, hidden fees, and vague policies, and suddenly canceling feels as complicated as decoding ancient hieroglyphics.

Step-by-Step Guide to Canceling Your Convention Insurance Plan

Step 1: Review Your Policy Details

Optimist You:* “I’ll skim through the document quickly; it should take five minutes!”

Grumpy You: “Oh no, sweet summer child. Be prepared to lose an afternoon.”*

Seriously though, sit down with a cup of coffee and comb through every single detail of your policy. Look for:

- Cancellation deadlines

- Refund eligibility

- Penalties for early termination

Step 2: Contact Customer Support

This step might sound simple, but brace yourself—it’s usually where things get hairy. Have these details ready:

- Your account number

- Date you purchased the plan

- Reason for wanting to cancel

If they give you pushback, stay calm and ask to speak to a supervisor.

Step 3: Send a Written Request

Follow up any verbal requests with a formal email or letter confirming your intent to cancel. Keep it short, professional, and include relevant dates and account info.

Best Practices When Attempting to Cancel Your Plan

#1: Read Everything Twice

This includes receipts, contract summaries, and email confirmations. Trust me; missing critical clauses can cost big time.

#2: Avoid Terrible Advice Like This One:

“Just ignore it—it’ll go away on its own.” Nope. That’s how debts pile up faster than Netflix subscriptions.

#3: Use Screenshots Liberally

If you’ve dealt with unhelpful support agents or suspect something fishy, screen-capture EVERYTHING. Think of them as evidence in case things escalate.

Real-Life Examples of Successful Conventional Insurance Cancellations

Take Sarah, a freelance photographer who successfully canceled her $250 convention insurance after realizing she booked the wrong event date due to miscommunication. She documented all interactions via email, filed a dispute with her credit card company when denied initially, and eventually got a full refund.

On the flip side, there’s Jake, whose rushed decision to skip reading his policy led him to burn $75 in non-refundable costs. Lesson learned: Slow down, people!

Frequently Asked Questions About Convention Insurance

Q: Can I cancel my convention insurance at any time?

No. Most insurers have specific timelines during which cancellations are allowed. Miss those, and say goodbye to refunds.

Q: Will I always receive a refund?

Not necessarily. Some companies slap hefty penalties for late cancellations.

Q: What happens if the convention gets canceled?

Check your policy—you might qualify for a full refund under force majeure clauses.

Conclusion

In conclusion, canceling a convention insurance plan doesn’t have to be soul-crushing—if you approach it strategically. From understanding your policy to documenting every interaction, preparation is key. But remember: sometimes, flexibility beats stubbornness.

And now, as promised… here’s your daily dose of nostalgia:

Like dial-up tones, Waiting for answers looms long— Hang tight, friend. You've got this.