“Ever hosted an event only to have it rain on your parade—literally?”

Picture this: You’re throwing a convention for 1,000 attendees, complete with keynote speakers, catered meals, and swanky decor. Now imagine a freak storm rolls in, forcing you to cancel. Or worse, someone trips over a power cord and sues. Without Event Insurance, you could be staring down a financial disaster.

In this post, we’ll unravel everything about Event Insurance, from why it exists to how it saves your bacon when things go wrong. By the end, you’ll know:

- Why Event Insurance is as essential as coffee at an 8 AM networking session

- Steps to pick the perfect plan

- Real-life examples where Event Insurance became a lifesaver

<

Table of Contents

- Why You Need Event Insurance

- Types of Coverage Included

- How to Choose the Right Plan

- Examples From Real Events

- FAQs About Event Insurance

Key Takeaways

- Event Insurance protects against cancellations, accidents, and unexpected mishaps during events.

- Different policies cover venues, vendors, liabilities, and more—tailored to your specific needs.

- Picking the right insurance requires understanding your risks, budget, and event scope.

Why You Need Event Insurance

“Optimist You”: “Oh, nothing will go wrong!”

Grumpy You: “Yeah, sure, because life always goes according to plan.”

Your optimism might be admirable, but let’s get real. Accidents happen—even to the best planners. Whether it’s inclement weather, no-show vendors, or injuries at the venue, these scenarios can cost thousands if you’re uninsured.

For instance, I once helped organize a charity gala that had to shut down mid-event due to a sudden fire alarm issue (false alarm, thankfully). The cleanup costs alone were astronomical, not to mention refunds for guests who left unhappy. If we’d invested in Event Insurance beforehand, all those bills wouldn’t have fallen squarely on our shoulders.

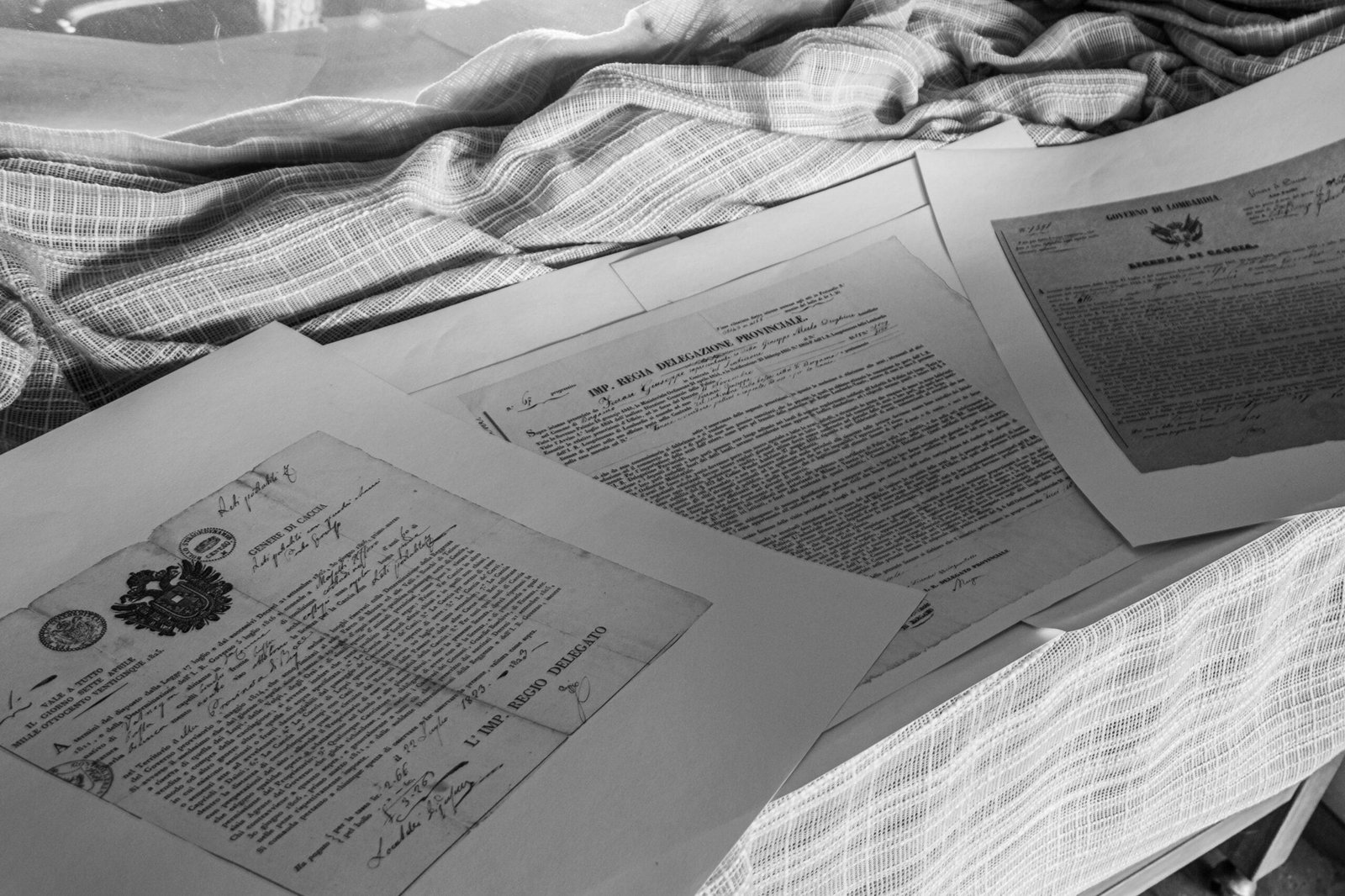

Figure 1: Common Risks Covered by Event Insurance

Types of Coverage Included

1. Cancellation Insurance

This safeguards you if an unforeseen circumstance forces you to cancel your event entirely. Think wildfires, pandemics, or natural disasters.

2. Liability Insurance

If someone gets hurt or property damage occurs at your event, liability coverage ensures they don’t come after you personally.

3. Venue Damage Protection

A must-have for rented spaces! Vendors accidentally scratch floors? Caterers spill soup everywhere? This policy’s got you covered.

How to Choose the Right Plan

Picking Event Insurance isn’t rocket science, but skipping due diligence is a recipe for regret. Here’s how to do it right:

Step 1: Assess Your Risks

Consider potential hazards unique to your event. Outdoor festival? Weather risks are high. High-profile gathering? Security and liability concerns loom large.

Step 2: Compare Providers

Companies like Markel, ACT, and Specialty Insurance offer tailored plans. Request quotes, read customer reviews, and compare their terms carefully.

Step 3: Double-Check Exclusions

RANT ALERT: Ever seen fine print that makes you want to scream into a pillow? Yeah, me too. Policies often exclude certain scenarios, so make sure you understand what’s NOT covered before signing.

Figure 2: Event Insurance Provider Comparison

Examples From Real Events

Let’s geek out over some inspiring success stories:

Case Study #1: The Music Festival Disaster

An indie music festival in Texas faced torrential rains just two days before opening night. Thanks to Event Insurance, organizers avoided losing their entire investment by filing a claim for cancellation expenses.

Case Study #2: A Wedding Planner Saves the Day

A wedding planner whose client slipped on a wet dance floor was sued for negligence. Because she carried liability insurance, her company remained financially intact.

Frequently Asked Questions About Event Insurance

Q: Is Event Insurance mandatory?

No, but most venues require proof of coverage before booking.

Q: How much does it typically cost?

It ranges from $150–$500 depending on event size and risk level.

Q: Can I add extra riders?

Absolutely! Many insurers allow custom add-ons like cyber liability or equipment theft protection.

Conclusion

To recap, Event Insurance is the ultimate safety net for anyone planning gatherings—from intimate workshops to massive conventions. By assessing your risks, comparing options, and avoiding sneaky exclusions, you can sleep soundly knowing you’re protected.

Like a Tamagotchi, your events need daily care—and sometimes, they need backup plans too.

Figure 3: Peace of Mind Comes with Proper Planning